30 May 2007

29 May 2007

28 May 2007

25 May 2007

24 May 2007

23 May 2007

22 May 2007

21 May 2007

18 May 2007

17 May 2007

16 May 2007

15 May 2007

14 May 2007

11 May 2007

10 May 2007

09 May 2007

08 May 2007

07 May 2007

04 May 2007

03 May 2007

02 May 2007

01 May 2007

Yen/USD Rate

What makes it so Important?

USD$1 = xxx.xxx YEN shows how much Yen can be converted from USD$1. When Yen is relatively stronger than USD the situation is not good for Yen Carry Traders.

Here is the simple analogy to understand basic of Yen Carry Trades. Imagine you borrow interest free money (Yen) to invest in US market. At the beginning, for every 125 Yen you get USD$1. In situation of your investment yields about 10% you shall gain 10% (USD$1.10) because it is interest free. However, in one very fine day, the Yen becomes relatively stronger than before. Let say you converted back USD$1.10 with USD$1 = 110 Yen rate, you receive 121 Yen and you still loss of 4 Yen.

So what is the point? You will not wait the Yen to become stronger before converting it to Yen to avoid unnecessary losses. You will then sell all your investment before the situation turns sour which is unfavored to the market.

Category Articles

STI Breadth

Introduction

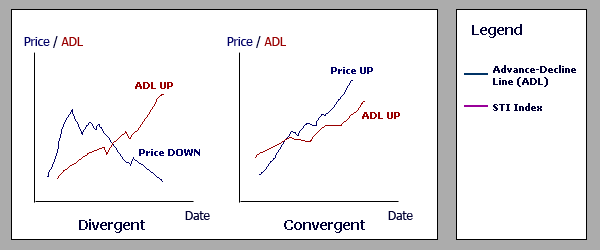

Breadth Line chart is calculated based on the Breadth Line Value (as known as Advance-Decline-Line). Breadth Index is used to measure internal strength of the market. An index may be rising but lacked of internal strength therefore it might gives investor wrong information on the market.How to Use

On days when the number of advancing stocks exceeds the number of declining stocks, the breadth line will rise. On days when more declining stocks than advancing stocks, the line will fall.

When comparing with the price of the stock, a negative divergence trend might suggests signal of weak market. For an example, in some cases of end of bull market, only some large market cap stocks continue to rise. The index will rise due to these stock hence will gives investors an implication that market is still strong. However, this is wrong because the market is not boardly advancing and the risk level increases as divergence continues.

House Number

| 01 AmFraser 05 UOB KH 08 CS 12 Lim&Tan 17 CIMB-GK 20 Philip 21 KimEng 25 Daiwa 26 BNP 28 OCBC 29 DBSV 31 DMG 35 SBI E2 36 Fortis Clearing | 39 Instinet Singapore 43 OCBC 70 CLSA 71 Nomura 72 Daiwa 73 Macquarie 77 ABN 78 Merrill Lynch 79 JPM 82 MS 83 Citigroup 84 UBS 86 DBSV Online 87 Westcomb |

Donation

Enjoy what you have been reading? You can show your support by donating to the author. In return of your donation, you will be added into the mailing list and will be first updated once a new article is posted on the website.